Everyone says the same thing: “Wait for December. That’s when the deals are.”

I’ve repeated that advice myself in the past. But I got curious: is December actually the best time to lease a car… or does it just feel that way because every dealership runs “HOLIDAY EVENT!!!” ads?

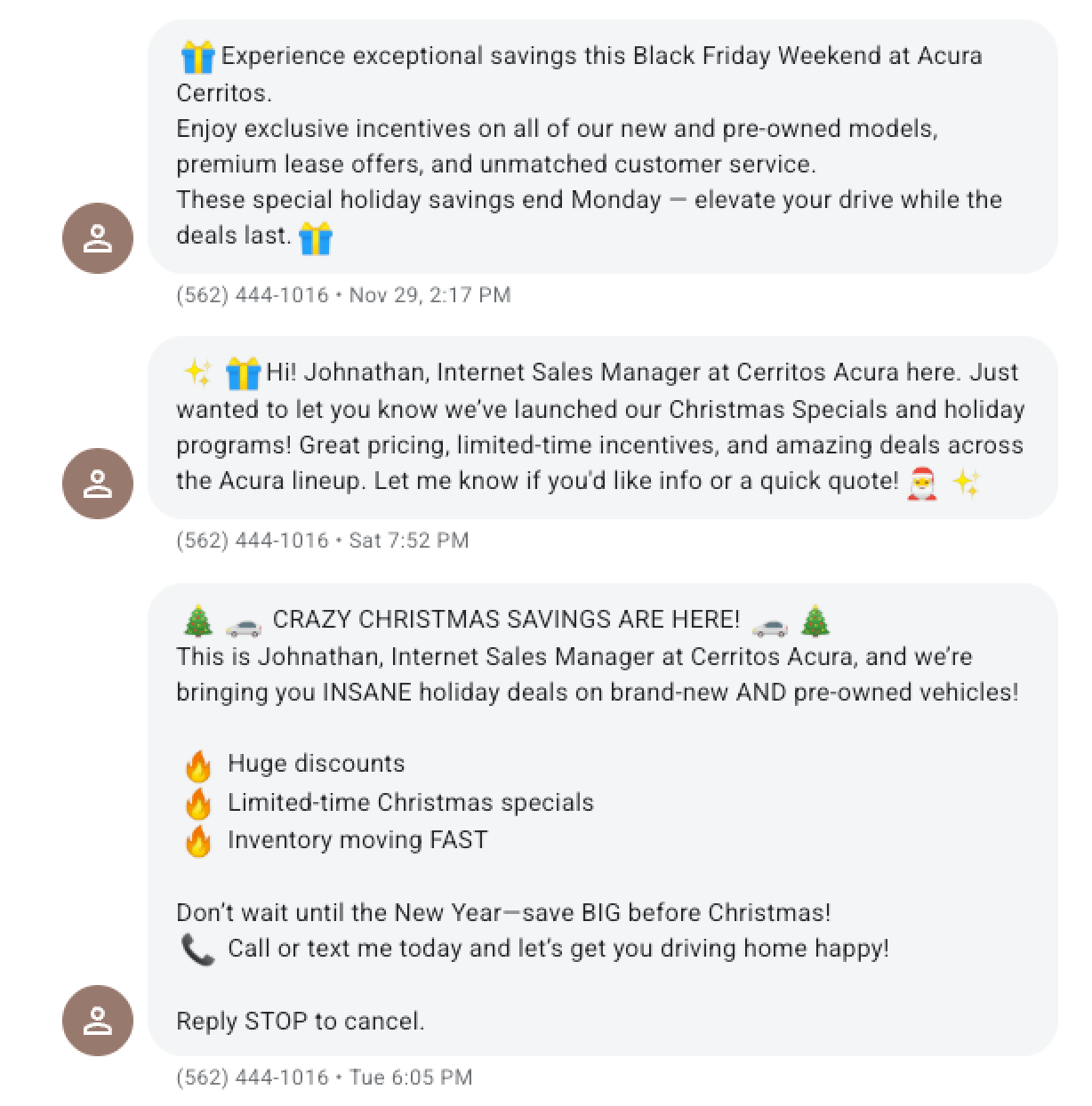

They even text you non stop these days (and that Jonathan needs to chill it.)

So I pulled a dataset of Leasehackr-posted lease deals and looked at it month-by-month—focusing on 10,000 miles/year leases (because it’s the most common mileage and makes apples-to-apples comparisons easier).

This is not meant to be “the truth about the market.” It’s meant to be a reality check, using a dataset that is at least grounded in real deals people posted.

TL;DR (answer-first)

If you define “best” as strong median deal quality, December isn’t it in this dataset.

- On median Leasehackr Score, November is the clear leader, with April / March / September also ahead of December.

- On median effective monthly as % of MSRP, November is again best (lowest), followed by April, then September / March. December is near the worst on this metric.

- If you only look at % off MSRP, March looks great—but discount doesn’t reliably translate into the best lease value.

The short version: December isn’t a reliable “best month.” The “best” months in this dataset skew more toward spring and early fall, with November showing up a lot as well.

Why people believe December is best

A few reasons this idea sticks:

- “End-of-year” and “model-year changeover” stories

- Heavy holiday marketing (it’s everywhere)

- Assumption that discounts and financing are seasonally better

And to be fair—December can be a good month. The issue is the word “best,” as in “best every year, for most people, across most cars.” That’s the claim I wanted to pressure-test.

Data & method (simple + reproducible)

Source

- Signed lease deals posted on Leasehackr (full dataset for download)

What I filtered to

- Only 10,000 miles/year deals (to keep the comparison clean)

- Missing values excluded (details below)

Metrics I used (and why)

I used three metrics, because each tells a slightly different story:

- Leasehackr Score (higher = better)

This is Leasehackr’s deal-quality score. It’s not perfect, but it’s a common shorthand people use when comparing deals. - Effective Monthly as % of MSRP (lower = better)

This normalizes across expensive vs cheaper cars. It’s basically effective monthly payment divided by MSRP. This is so you can compare a $50k car and a $75k car without fooling yourself. - % of MSRP Off (higher = better)

This is the discount off MSRP. Useful, but it can be misleading for leases (more on that below).

Two ways I measured “best month”

Because “best” can mean two different things:

- Typical deal quality: use the median by month (what a “normal” deal looks like)

- Odds of a great deal: count of deals in the top 10% by month (how often big outliers happen)

Data cleaning / exclusions

- Deals missing [Leasehackr score / MSRP / effective monthly / month] were excluded from the relevant calculations.

- I did not try to “fix” messy posts; I’m using what’s there and being explicit about limitations.

Method in 60 seconds:

- Filter to 10k-mile deals

- Group by month

- Compare medians across months

- Define “top 10%” and count how many each month produces

Results: Is December actually better?

1) Typical deal quality (medians)

This is the “what does a normal deal look like in each month?” view.

- On Leasehackr Score, the strongest median months were: November, April, March, and September. December ranked 11th.

- On effective monthly % of MSRP, the strongest median months were: November, April, and September. December ranked 11th again.

- % off MSRP sometimes diverges from the lease value metrics. That’s not a bug—it’s the point: on leases, the program matters, not just the discount.

Quick note on the “% off MSRP” trap

People fixate on discount because it’s easy to understand. But a lease can look “discounted” and still be mediocre if:

- the money factor is ugly,

- the residual is weak,

- incentives are different month-to-month,

- fees are padded, or

- the deal is structured in a way that hides cost (big drive-offs, etc.)

So I treat discount as supporting evidence, not the main event.

Verdict (typical deals): Based on the median outcomes above, December is not a consistent #1 in this dataset. In fact, it is one of the worst.

2) Odds of a top-tier deal (top 10% counts)

If you look at where the top 10% of deals show up, the “December is deal season” idea gets even weaker.

- For Leasehackr Score and effective monthly / MSRP, September is the biggest spike in top-tier deal share.

- April and November also show up as strong months for top-tier deals.

- December is near the bottom for top-tier share on both value metrics (it’s a small bar compared to the leaders).

What’s interesting: December does show up more for “top % off MSRP” than it does for top-tier lease value. In other words, you can find big discounts in December, but that doesn’t automatically convert into the best leases.

Plain-English conclusion: In this dataset, the best-of-the-best deals cluster more in September (and also April/November) than in December.

Why December can still feel like “deal season” (even if it’s not always #1)

A lease payment is driven more by program structure than by the calendar:

- incentives and rebates (which can change monthly)

- residual support (huge for payment)

- money factor policies (also huge)

- inventory and model-cycle timing (what dealers actually need to move)

So yes—December can line up with strong programs and pressure to clear inventory. But if the program is weak, holiday decorations don’t fix it.

Bottom line: “It’s December” is not a strategy. “The program is strong and dealers have inventory pressure” is a strategy.

Add-on analysis: Do lease APRs track the Fed?

This is a side question I see a lot: “Should I wait until rates normalize?”

Here’s the simple version: sometimes, but not cleanly.

- Estimated pass-through (≈ 0.32): A 1-point change in the Fed rate corresponds to about 0.32 points in lease APR in this dataset.

- R²: Fed rate explains about 22% of lease APR variation here, which means a lot of lease APR movement is driven by other things (program subsidies, captive finance policy, promos, dealer behavior).

Practical implication: Waiting for rates to drop can help, but it’s not a reliable leasing strategy on its own. If the program is strong, you can still get a solid lease in a higher-rate environment. If the program is weak, low rates don’t automatically save you.

Practical guidance

If you need to lease, lease—but don’t do it expecting December to automatically hand you a great deal.

What does reliably improve outcomes is process:

- Compare multiple offers side-by-side (at least 3)

- Normalize the deal (effective monthly, all-in)

- Verify the quote details: fees, due-at-signing, term, mileage

- Be flexible on color/options when possible

- Be willing to walk when the math doesn’t work

If you want the full “how I do this without losing my sanity” method (mostly negotiating by text), I wrote it out in detail on Reddit. It’s the same approach I use personally.

Limitations

A few important caveats:

- Leasehackr posters tend to research, cross-shop, and optimize more than average shoppers. This likely biases posted deals toward stronger outcomes overall.

- Month-to-month sample sizes can vary. Some months may have fewer posts, or the mix of brands/models may change.

- Missing values exist, and excluded rows can affect results.

Treat this as directional evidence, not a perfect model of the entire market.

FAQ

Is December the best month to lease a car?

No. December can be a strong month, but it does not reliably lead on either the typical deal (median outcomes) or the concentration of top-tier deals.

What month is best to lease a car (based on your analysis)?

It depends on the metric. In my dataset, the “best” months by median were November and April, while the highest concentration of top-10% deals occurred in November and September.

Why do people say December is best for car deals?

Because end-of-year marketing and model-year narratives are loud, and sometimes December overlaps with strong incentives and inventory pressure. But the lease program matters more than the month.

Does % off MSRP mean it’s a good lease deal?

Not necessarily. Discount helps, but leases can still be mediocre if the money factor is high, residual is weak, or fees/structure add cost.

Do lease APRs follow the Fed rate?

Partially. In this dataset, there is some relationship, but the Fed rate explains only ~22% of the variation—meaning program and lender policies often dominate.

What matters most when trying to get a good lease deal?

Program strength (residual + money factor + incentives), the negotiated selling price, and the all-in structure (fees, due-at-signing), compared apples-to-apples.